Investor Interest Levels Off: Purchases Stabilizing Amidst COVID Market Frenzy

This article originally appeared in Mortgage Banker Magazine by Sarah Wolak, Staff Writer

After a frenzied market during the peak of COVID, investor purchases are finally beginning to stabilize, not slow down. Years of soaring property prices and a red-hot real estate market have given way to a new reality: what goes up, must come down. As the global economy grapples with unprecedented challenges, property investors are witnessing a shift in the market, with prices starting to cool and demand showing signs of waning.

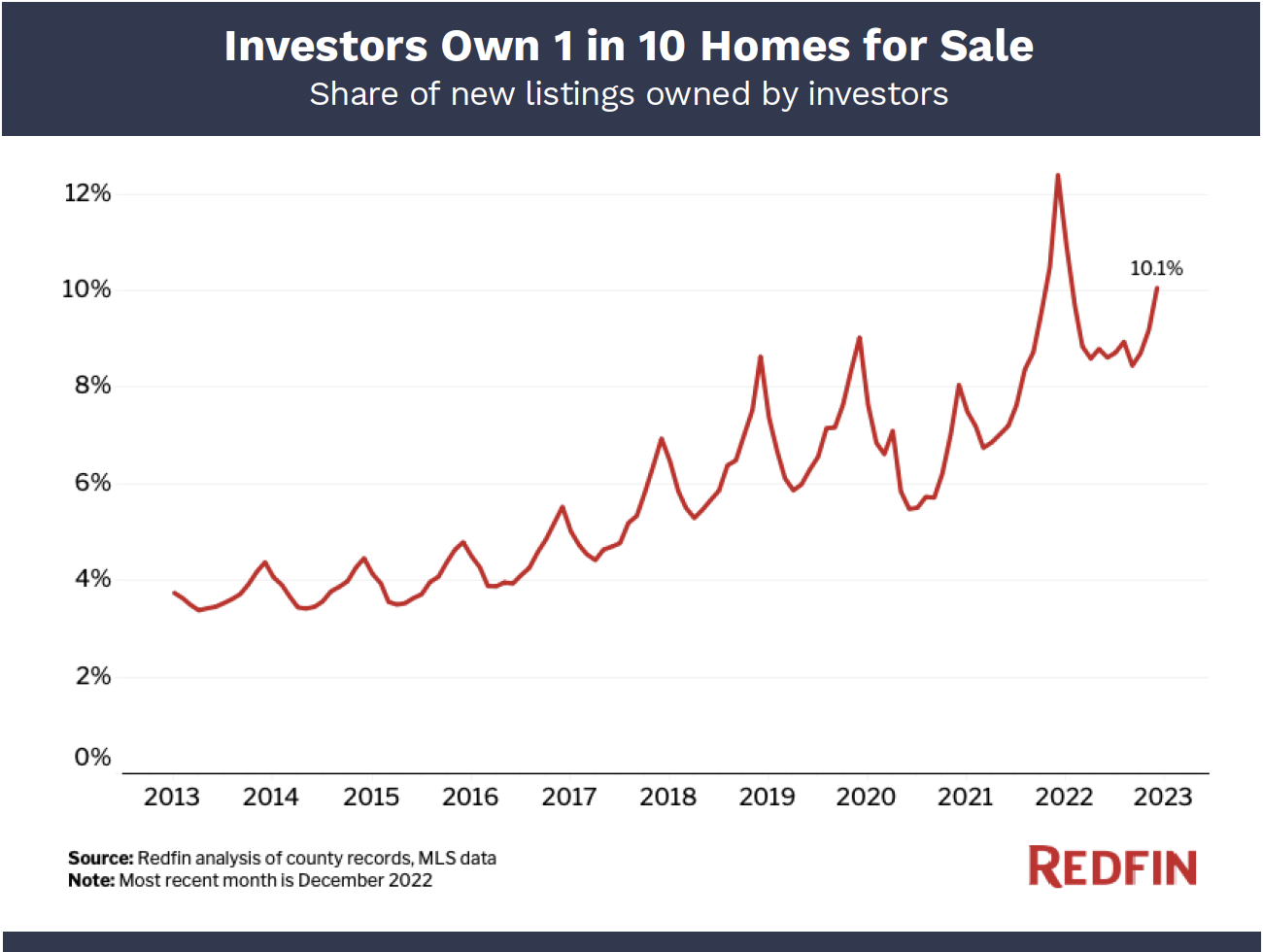

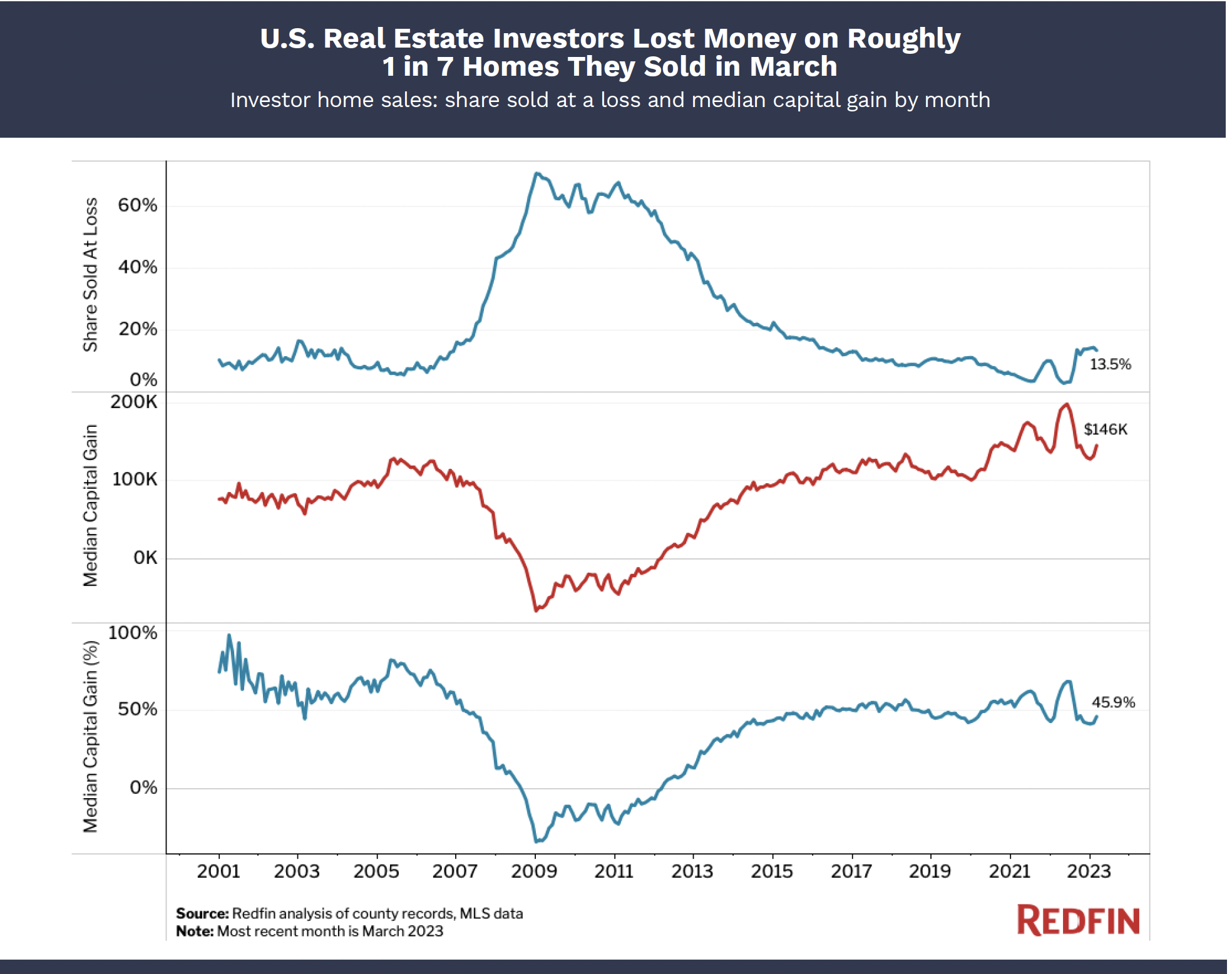

During the middle of the COVID-19 pandemic, investor purchases experienced a record spike, only to face the sharpest decline ever recorded at 45.8%. This surpasses the 45.1% slump witnessed during the 2008 housing crash. A recent report by Redfin revealed that one out of every seven homes sold by an investor resulted in a loss compared to the purchase price, causing many to miss out on potential gains.

“For the investor market, the slowdown is a combination of higher borrowing costs. However, we haven’t seen valuation fall, as measured by the capitalization rate, to offset the borrowing costs. So, I think some investors are saying, ‘Let’s wait’ for rates to come down.” – Fred Matera, Redwood Trust (parent company of CoreVest)

While Redfin considers this data a red flag for the investor community, others are not alarmed by the seemingly sudden drop in purchases. Melissa Deal, head of sales at Haus Lending, views the decline as a natural leveling off of investor activity following a period of rapid growth from mid-2020 to early 2022.

For Deal, this is not a cause for concern or an indicator of an impending recession. She explains that the remarkable surge in numbers had to come down eventually. “Trees can’t grow to the sky; the numbers couldn’t keep going up,” she quips. “Investor home purchases hovered around an average of thirty or forty thousand units pre-pandemic, spiked up to 150,000, and now they’re declining. But we’re still on a gradual, stable trajectory.”

Fred Matera, Chief Investment Officer at Redwood Trust, says that the company’s subsidiary, CoreVest, hasn’t seen investors shy away. He suggests that the slowdown in investor activity is a combination of higher borrowing costs and the absence of a corresponding decrease in property valuations to offset those costs. Matera believes some investors are adopting a wait-and-see approach, anticipating a decline in interest rates before resuming their purchases.

“We deal primarily with small to mid-sized investors,” Matera explained. “Investors did step up their presence in residential mortgages over the last few years, but a lot of the larger purchases were done by institutional investors. So smaller investors that we handle have stayed relatively stable.” While some investors have decided to slow down, Matera assures that this is cyclical and isn’t anything to be concerned about in the meantime.

Matera also says that he’s seen investors with CoreVest have extra capital to play with. “There’s a tremendous amount of lending capacity and dry powder among our clients, meaning available capital, like accessible cash and stocks, that can be sold,” he said. “It was pretty busy out of the gate this year, but they’re taking time to sit back and see what the best financial decisions are for them.”

According to Kennedy, a market correction is underway after the frenzy during the peak of the COVID-19 pandemic. While demand is picking up, the market is still relatively healthy. Kennedy points out that people are taking longer to pay off loans, but there is no cause for panic. Factors such as supply chain issues, labor shortages, and lumber prices have become less concerning, and overall market risks have diminished.

RCN Capital’s business development manager, Stephen Ballard, views the current cooling of markets and investor activity as a natural cycle. Ballard notes that today’s homes are more affordable than they were six months ago, despite the high-interest rate environment. He emphasizes the need for caution and protection of clients in the tighter market conditions, favoring higher credit scores, more equity, and conservative financial approaches.

Despite the raw data from Redfin, both Deal and Kennedy affirm that investors are not deterred. Deal suggests that housing prices have a limit to how far they can fall, and despite the slowdown, the percentage of flipped houses continues to rise. Matera echoes this sentiment. Lending capacity and available capital are still abundant, providing opportunities for strategic investments.

Charles Weinraub, a professional flipper and owner of Handsome Homebuyer, remains undeterred by the challenges of the current market. Despite interest rate hikes and unstable market conditions, and the building departments taking forever to issue building permits, it’s nearly impossible to do business.”

However, Weinraub isn’t discouraged by the seemingly impossible ways to do business. He says that he has been approaching first-time homebuyers for safe investment opportunities. “People will always buy houses. Interest rates at 2% or 20%, people will always buy houses. As a business owner, you have to be willing and able to make adjustments to meet market demand,” he said. “For the near future, I’ll concentrate on the first-time homebuyer market. That’s where we see the biggest demand and the lowest supply. These are the safest investments.”

View the original article here.

#IG