Complete Guide to Build for Rent Investing

Introduction

In recent years, Build for Rent (“BFR”) has been one of the fastest growing asset classes of the US housing market due to high rental demand, large influx of capital and exceptional business performance. In fact, according to Green Street, the expected risk-adjusted annual return for Build for Rent investments in the private market is the highest of 18 property sectors tracked by the firm. (Parker, 2021).

CoreVest has been at the forefront of this BFR boom, having closed approximately $1.5 billion in loans on 10,000 BFR units. To help investors explore the key aspects of BFR that make it a viable, scalable, and potentially rewarding opportunity, we present this Complete Guide to Build for Rent Investing below. If you would like to download the PDF version instead, click here

“Building and Renting Single-family Homes is Top-Performing Investment.”

– The Wall Street Journal, November 2021

What is "Build for Rent"?

Many different strategies and terminologies exist under the same category that we collectively refer to as BFR Investing. For example, some developers have the infrastructure to build rental properties from the ground up (also known as Build to Rent, BTR or B2R) while others need to form partnerships with builders to purchase newly finished homes for rent (sometimes referred to as Buy to Rent). Both scenarios are considered Build for Rent Investing in this guide.

BFR properties are designed for the purpose of renting to long-term tenants who generally enjoy living comfortably without the hassles and costs of home ownership. As such, BFR properties typically offer elevated features and amenities while incorporating materials that can withstand long-term wear and tear. The chart below highlights some of the common amenities that are often found in BFR properties.

Top Home Amenities

1. Laminate or tile flooring

2. Walk-in closet, dual vanities

3. Stainless steel appliances

4. Kitchen island, granite counters

5. Dedicated parking

6. Backyard patio

7. Washer and dryer included

Top Community Amenities

1. Pool and Spa

2. Clubhouse

3. Walking trail

4. Park, playground, picnic area

5. Fitness center

6. Gated entrance

7. Barbecue area

BFR Property Types

Although each community is different, Build for Rent can be divided into the following broad categories.

- Densest project type within the BFR asset class

- Average of 10 – 12 units per acre

- Ranging from 800 sf to 1,200 sf

- Mix of one and two-bedroom, detached or semi-attached simplex units

- Units include private outdoor space, but may not include private parking

- Target tenant base is similar to that of traditional garden-style, mid-rise multifamily projects

- Average of 8 – 10 units per acre

- Ranging from 1,200 sf to 1,800 sf

- Mix of attached or semi-attached two, three and four-bedroom units

- All units include private outdoor space and private parking

- Typically targets couples, families, empty nesters, and retirees

- Offers “greenest” space of all BFR community types

- Average of 6 – 8 units per acre

- Ranging between 1,400 sf to 2,000 sf

- Primarily three or four-bedroom units

- Targets same renter pool as townhome communities

- Provides an experience that mimics owning a home

BFR Showcase – Cooper Crest, TX

Photos of BFR Properties at Cooper Crest, courtesy of Cor3 Capital

Investors choose to obtain BFR asset exposure in different ways: some build projects, others acquire projects. CoreVest closed a $40 million credit line for a client who is acquiring townhomes from a builder at certificate of occupancy. This strategy allows our client to acquire and lease brand new townhomes without taking on construction risk. The townhomes are located within four distinct BFR communities in multiple cities throughout Texas.

Why Invest in Build for Rent?

Higher Demand, Higher Returns

According to the US Census Bureau, more than 37% of Americans are now renters. In 2021, rental occupancy rates rose to nearly 94%. Experts believe this upward trend will continue post-COVID-19 and into the foreseeable future. A recent article in the New York Post states that US rent prices are the highest they have been in decades, and they aren’t coming down. (Zilber, 2022) In addition, BFR communities have the benefit of attracting specific demographics such as millennials. The Census estimates that 65% of Americans under the age of 35 are currently renting.

With very little new single-family rental inventory introduced into the market since the Great Recession (2008), many developers along with institutional capital partners are rushing to introduce new BFR projects. Not only are they filling a much-needed void, but they are also making more money as they do so. Green Street states that while the weighted average for all property sectors was 6.1%, the expected risk-adjusted annual return for Build for Rent investments was about 8% on average, almost a third higher. (Parker, 2021)

Expected risk-adjusted annual return for Build for Rent investments in the private market is the highest of 18 property sectors – Green Street, 2021

Key Factors Driving BFR

In addition to higher demand and higher returns, what are the factors that continue to drive the growth of BFR?

1. Changing Demographics

Record housing prices, uncertainty of markets, the desire to explore, and the ability to work remotely have put home ownership out of reach for some and out of interest for others.

2. Availability of Financing

Build for Rent financing is no longer limited to the largest developers. Investment lenders like CoreVest now offer more investors access to capital for a variety of creative BFR projects.

3. Low Saturation

Even with increasing interest, BFR investing still has ample room for growth in most markets. US housing is significantly under supplied and new builds are especially welcome.

4. More Exit Strategies

While some asset classes, such as commercial, are sold to investors of that asset class, BFR properties can be sold to a new home buyer, the existing tenant, or another investor, etc.

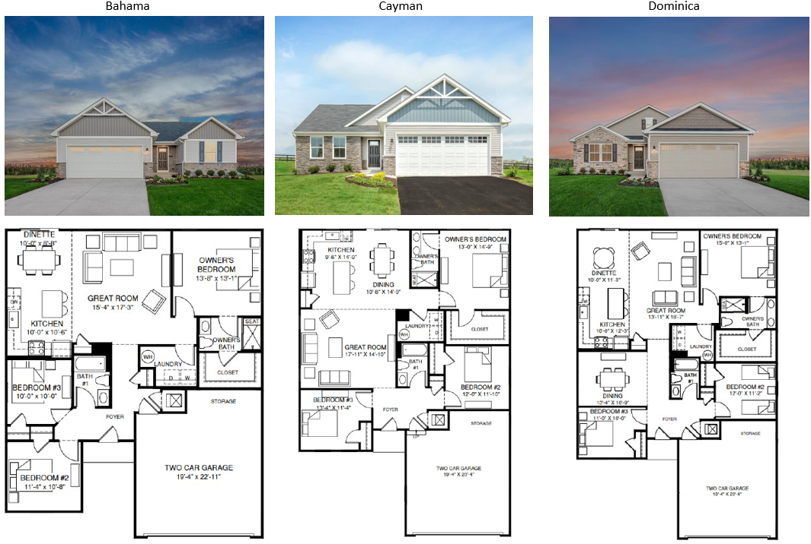

How to Develop BFR Communities

Developers can maximize desirability as well as longevity with the proper planning of a BFR community. WAN Bridge Group, a large BFR developer and client of CoreVest, shares the following preparation tips and general steps to complete a BFR development:

Preparation Tips

1. Design with tenants in mind

Design homes that will appeal to tenants, incorporating thoughtful elements such as spacious floorplans and upgraded finishes to stand apart from typical rentals.

2. Consider different home sizes

Provide a range of home sizes and price points within a community to satisfy a broad range of tenant needs.

3. Identify unique benefits and amenities

Plan communities that offer unique amenities, including playgrounds, parks, walking trails, waterfront access, and other exclusive benefits for residents to enjoy.

4. Location, location, location

Pinpoint specific regions/cities in which there is high demand for BFR homes to ensure optimal capacity.

5. Line up the right partners.

Work closely with building and supply partners to secure the best-possible construction costs so that savings can be passed along to tenants.

Development Steps

1. Select a target area

Use real estate data that breaks down demand in a region, current rental options, and other key information to select your location.

2. Acquire the land

In some cases, this occurs through a partnership with the landowner (a financial arrangement may be made in which the landowner receives a portion of the profits).

3. Finalize partnerships

Once land is acquired, it is important to finalize contracts with investors, builders, and other entities.

4. Design and construct the homes

Remember to fully include community amenities, landscaping, and other key features in your design, timeline and budget.

5. Market the BFR homes for rent

This is an exciting stage in the development process. Marketing can be done directly by the developer or through a leasing company.

6. Consider professional management

Allowing a professional property management team to handle ongoing community needs and maintenance ensures that your investment will be well cared for.

BFR Showcase – Clublands of Antioch, IL

Photos of BFR Properties at Clublands of Antioch, courtesy of Moda Homes

CoreVest closed a $29,960,000 bridge loan to finance the development of 110 Build-For-Rent single family homes in Lake Country, IL. The homes will be built in an established master-planned community, including amenities such as a clubhouse, fitness center, pool, and picnic area. Each property will feature granite countertops, stainless-steel appliances, in-unit washers/dryers and wood floors. Located in a market that has seen positive annual rent growth, this development will help to satisfy the rapidly growing demand for single-family rentals.

Pros and Cons of Build for Rent

While Build for Rent may have growing appeal, investors should also carefully evaluate the pros and cons of this strategy.

Pros of BFR Investing

1. Higher Rents

BFR units typically offer similar amenities and conveniences to that of multifamily apartments along with the privacy of single-family homes. As such, they can command higher rents than both asset classes.

2. Less Tenant Turnover

While large, traditional apartment complexes tend to appeal to more temporary renters, BFR properties appeal to those who want additional customization and are prone to staying longer.

3. Less Competition

Scarcity of inventory has driven up prices on homes and has led to fierce bidding wars on the market. By adding their own inventory, developers can avoid competition in the acquisition stage.

4. Ideal Build

Each market may have an “ideal” house build that best meets demand. While it is very difficult to find a pool of existing ideal homes, building them ensures that those specs are met.

Cons of BFR Investing

1. Limited Availability

Buildable, viable land is just as scarce or even more scarce to acquire than homes. Each market will have varying levels of availability, but top markets will certainly be very limited.

2. Hard to Compete

Smaller developers have to contend with much larger ones in a market. Experience, partnerships, and economies of scale tend to work in favor of the larger companies with deeper connections.

3. More Expensive

Because of the scale of the development, BFR is more expensive upfront than single fix and flips, for example, where investors can deploy capital one property at a time.

4. No Instant ROI

While newer homes typically net higher rents and future appreciation, it is not the same as finding instant, lucrative returns on a discounted property for renovation.

BFR Developer Testimonials

Build for Rent Trends

As a growing asset class, Build for Rent continues to evolve. Below are the top 5 trends that members of our team currently see in the BFR marketplace:

1. Land Costs Continues to Rise

One of the biggest pain points for developers is increasing land cost. It’s becoming extremely difficult to find affordable lots as new players continue to enter the market. The resulting increase in competition for land is pushing developers into new markets that were previously not considered. – Brandon Turk

2. Bigger is Better

Bigger is indeed better. There is substantial demand for 4- and 5- bedroom houses with an average premium of $150-$200/month per bedroom. If it is possible to build an extra bedroom within the same home footprint, investors should strongly consider it. They should also embrace technology as there is a premium for smart homes. – Boris Zhuravel

3. More Means Less

As many new SFR/BFR funds launch into the space, cap rate compression is deepened because investors are betting that they can continue to raise rents in the future. – Joakim Mortensen

4. Some Like to Mix It Up

There is increased interest in building multiple asset types in the same transaction. For instance, borrowers would discuss a mixture of townhomes and SFRs, or even garden style apartments and townhomes being built in one community. Some would consider selling one asset class upon completion, others would look to hold all development. – Brendan Hamilton

5. Pricing Over Leverage

A lot of developers are less concerned about the amount of leverage and more focused on the rates. There seems to be a lot of money in the market, with many developers having moved a decent amount of their capital from stocks and other holdings into real estate. So, to these developers, it’s about the total return and not the rate of return since leverage amount has a greater impact on rate of return than coupon. – Stefan Malmund

How CoreVest Helps Developers

As a leading lender in the Build for Rent space, CoreVest has worked closely with developers to finance numerous BFR projects, totaling 10,000 units. Listed below are ways that CoreVest can help BFR developers grow:

1. We can lend on multiple BFR projects

This includes horizontal multifamily, townhome, detached SFR, or a combination of all of these.

2. We are not limited to single tax lot investments

This offers more flexibility during the development stage as well as for sale and/or permanent financing where other lenders may have limitations on multiple lot developments

3. We don’t have rigid lending boxes

We base our credit decisions on product quality, market demographics, and developer experience.

4. We are a true lifecycle lender

We’re able to finance at all stages of the project, whether it’s construction, bridge or permanent financing. Our unique model provides us the flexibility to jump in at any stage of a given project and finance it.

5. We are able to close BFR transactions in 30-45 days

Our in-house loan administration team ensures that we have visibility into the project at all times, allowing us to process draw requests efficiently and react quickly to keep the project on track.

6. There are no prepayment penalties

Avoiding prepayment penalties allows borrowers to consider many different BFR exit strategies.

7. Our loans can be non-recourse

We have the flexibility to provide accretive non-recourse financing at multiple leverage points, depending on need.

Build For Rent Loan

- New SFR construction loan + term loan

take out financing - $3M – $50M+

- Up to 80% LTC construction loan and

75% LTV term loan - 12-36 month construction loan

5 or 10 year term loan - Floating rate construction loan and

fixed rate term loan - Seamless construction draw process

- Non-recourse carve-out with

completion guaranty - Nationwide lending

References

Parker, Will. 2021. “Building and Renting Single-Family Homes Is Top-Performing Investment.” The Wall Street Journal. November 9, 2021. https://www.wsj.com/articles/building-and-renting-single-family-homes-is-top-performing-investment-11636453800

Zilber, Ariel. 2022. “US rent prices highest in decades — and they aren’t coming down: data.” New York Post. February 1, 2022. https://nypost.com/2022/02/01/us-rent-prices-highest-in-decades-and-theyre-not-coming-down-data-shows/

Wan Bridge. 2022. “A Complete Guide on Build-to-Rent Homes.” Wanbridge.com. Accessed February 21, 2022. https://wanbridge.com/educate/build-to-rent-homes-guide/